Clicks has just released the results of its special COVID-19 edition of the IT Recruitment & Retention Report, with survey data collected from Australian employers in July 2020. Typically, we survey the Australian IT business community at the end of each year to release a report at the start of the following year. The report provides insights into hiring intentions, IT spend, and hiring trends. However, events of 2020, in particular COVID-19 and its effects on our economy, careers and personal lives has rendered the data released in our January 2020 Report all but obsolete.

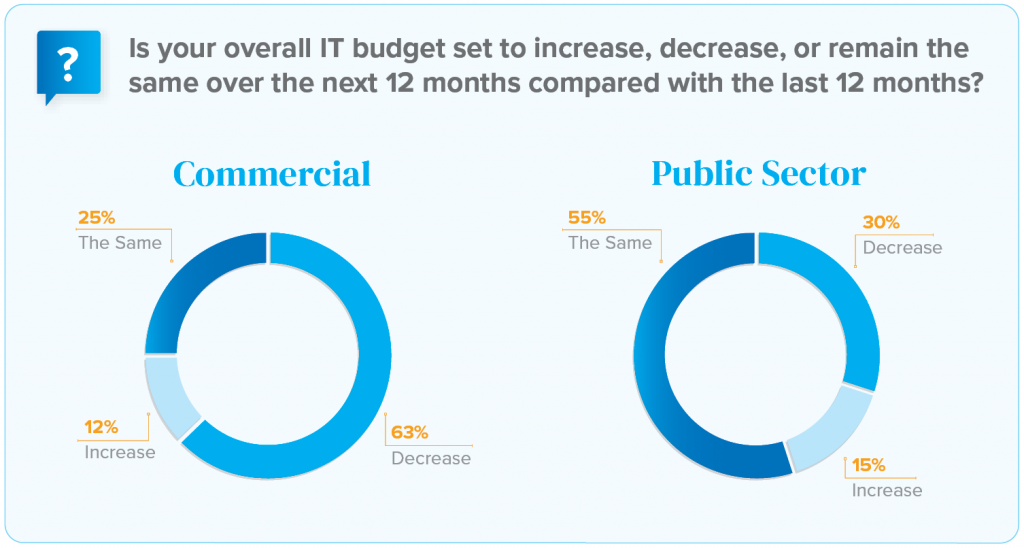

There has definitely been a downward trend across most of the reported measures. However, reports remain of increased IT budget and staffing needs, albeit reduced from six months earlier. Around half of all respondents are expecting to hold steady. This is unchanged from the ten-year trend, signalling stability for a significant proportion of the sector.

It comes as no surprise that nearly one-third of organisations reported an expected decrease in IT staff numbers over the next 12 months (compared to 20% in December 2019). However, more than half of respondents expect IT staff numbers will remain the same.

Additionally, reports on expected increased or decreased permanent IT headcount remain relatively consistent with data collected over the last five years, and did not drastically change as a result of COVID-19. Conversely, the report suggests IT contractors will be more impacted. 47% of respondents expected requirements for IT Contractors will decrease in the next twelve months compared to 28% six months earlier.

As workforces continue to automate and increase their presence and operations online, it is not surprising that parts of the IT sector are more insulated from the effects of COVID-19 than others.

It is interesting to note the variances of the impact of COVID-19 within the public and commercial sectors in IT:

This includes reported IT spend, roles that are difficult to recruit, and roles that are in demand.

For example, while reported demand for Business Analysts has dropped significantly and Digital roles has increased threefold, Business Analysts remain in higher demand within the public sector and Digital roles are more demand within the commercial sector.

Clicks maintains talent pools of senior technical practitioners with enterprise portfolios across a range of industries. If you have a major program of work in your pipeline and would like to discuss the most effective strategies for securing your required skillsets, please reach out to your Clicks Account Manager, or call us on 1300 CLICKS for a confidential discussion.